As the cryptocurrency market continues to evolve, it’s crucial to keep an eye on emerging trends and predictions. Today, we delve into the latest price predictions for Solana (SOL), Poodlana (POODL), and Bitcoin (BTC). Let’s break down the key factors shaping these assets and what investors should watch for.

Solana (SOL): A Glimmer of Hope Amidst Uncertainty

Solana has shown notable recovery recently, but it’s not completely out of the woods. Here’s what’s happening:

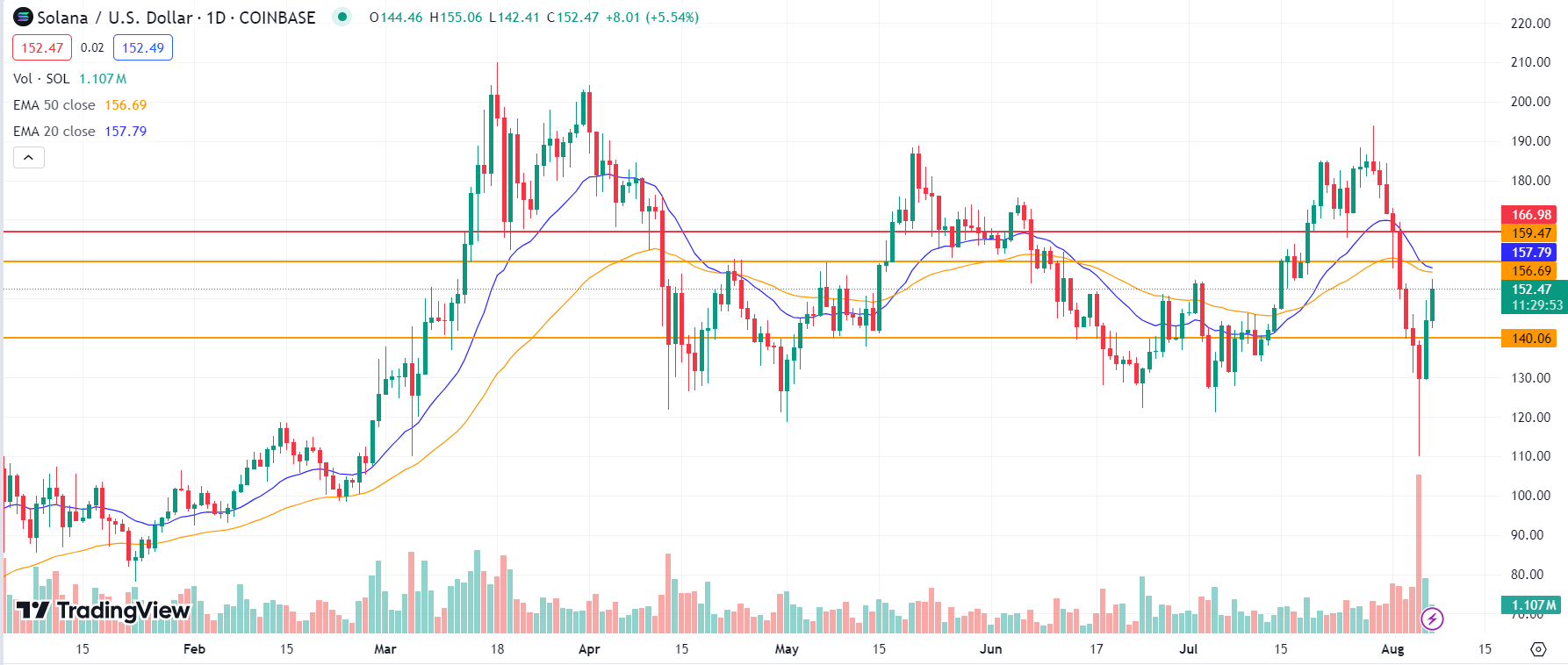

- Recent Performance: Solana, currently the fifth-largest cryptocurrency, rebounded from a five-month low of $110.47 on Sunday to trade at $152.12 by Tuesday. This represents a 9.15% increase in just 24 hours.

- Market Metrics: As of now, Solana’s market cap stands at $70.9 billion with a trading volume of $5.5 billion.

- Resistance and Support Levels: Despite the recent gains, Solana is still trading below the 20 and 50-day Exponential Moving Averages (EMAs). Short-term support is anticipated around the $140 mark, with resistance near $159.47. A successful breach of this resistance could set sights on the next level at $170.05.

Key Insight: The optimism surrounding a potential Solana ETF (exchange-traded fund) is boosting confidence. If Solana becomes the third token available to investors after Bitcoin and Ethereum, it could further drive its price.

Poodlana (POODL): A Meme Coin Making Waves

Poodlana (POODL), a meme coin under the Solana network, has generated significant excitement. Here’s the latest on this emerging asset:

- Presale Success: In just 10 days, Poodlana’s presale has raised over $5 million. The presale, which began on 17th July, is set to end on 16th August.

- Current Pricing: The current presale price is $0.0458, expected to rise to $0.0499 in the next stage. The final listing price is set at $0.060.

- Market Potential: With its strong viral traction, Poodlana presents a promising opportunity for meme coin enthusiasts. Given its fashion-centric branding and the growing interest in meme coins, Poodlana could offer substantial returns.

Key Insight: Meme coins like Poodlana have high return potential but come with inherent risks. Investors should be cautious but aware of the potential rewards from early-stage investments.

Bitcoin (BTC): Navigating Through a Dead Cat Bounce?

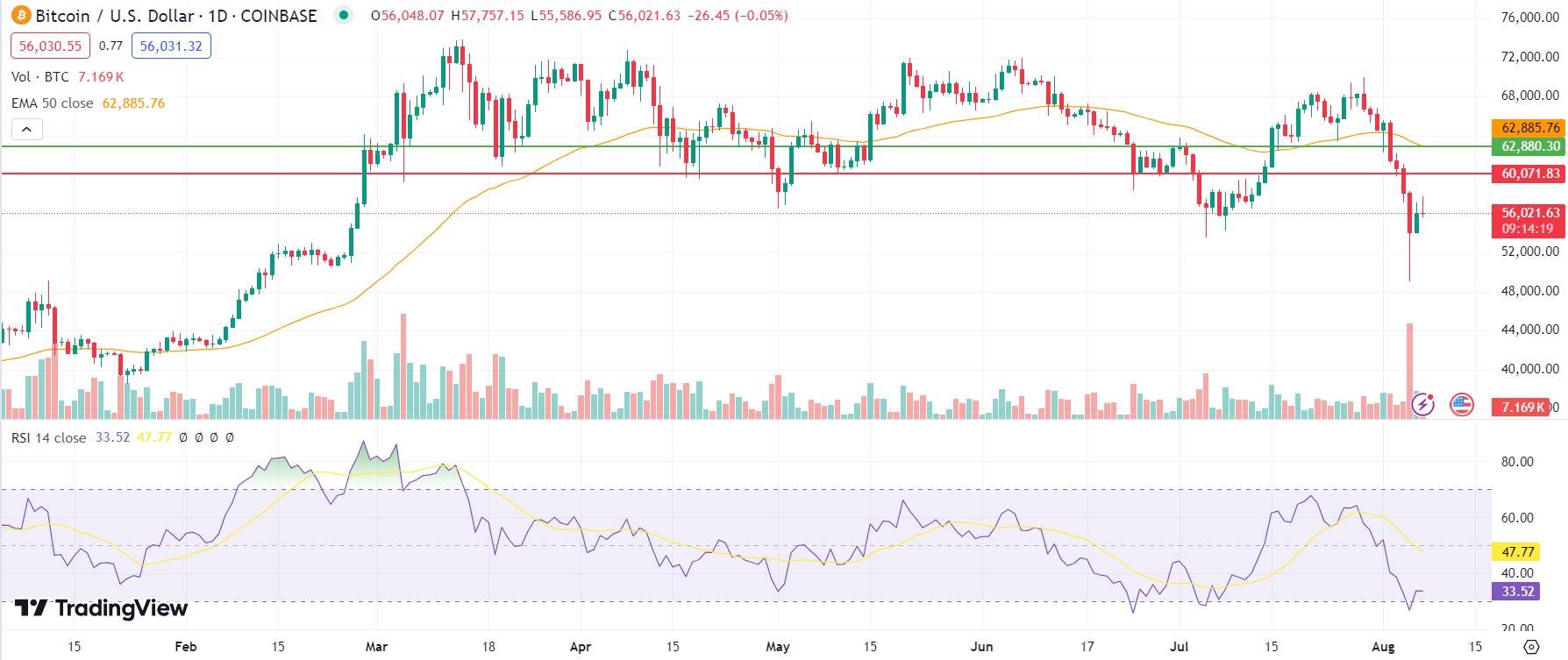

Bitcoin (BTC) has experienced a turbulent period recently, and its current situation could be indicative of a dead cat bounce. Here’s a closer look:

- Price Action: Bitcoin fell below the psychological $50,000 mark on 5th August for the first time since mid-February. While it has recovered slightly, it faces challenges breaking past the $57,500 support zone.

- Technical Indicators: With an RSI of 33, Bitcoin may experience temporary gains but could be poised for a downtrend. A significant reversal would require surpassing the 50-day EMA at $62,880.

- Short-Term Outlook: If the markets stabilise, Bitcoin could potentially push past the $60,000 mark. However, the path to a sustained recovery remains uncertain.

Key Insight: Bitcoin’s recent performance suggests caution. While short-term gains are possible, the broader trend may remain bearish unless significant momentum shifts occur.

What to Watch For:

- Solana: Monitor for movement around key support and resistance levels. Watch for news on potential ETF listings that could influence price action.

- Poodlana: Keep an eye on presale updates and potential listing impacts. The meme coin market can be volatile, so stay updated on community and market sentiment.

- Bitcoin: Watch for signs of trend reversal or further declines. Key technical levels and market sentiment will be crucial in determining Bitcoin’s short-term direction.

Relevant Keywords & Links:

- Solana – Solana Overview

- Poodlana – Poodlana Presale Details

- Bitcoin – Bitcoin Information

- Cryptocurrency Market Trends – Crypto Market Trends